At any given moment, people everywhere are reaching for a product to stay clean. There’s shampoo for hair, detergent for laundry, soap for dishes. Amid the scrubbing, scouring and washing that’s happening inside homes from Canada to China to Chile, who is responsible for keeping our world clean?

Unilever, the consumer goods company that makes many of those everyday personal care and household products, has an answer: Businesses, such as Unilever, have a responsibility to the consumers and the communities in which they have a presence.

It’s a belief that defines Unilever. Its business strategy, based on “sustainable growth,” aims to double its size while reducing its environmental footprint and increasing its social impact.

When the company sought capital to promote environmentally sustainable projects, Unilever turned to Morgan Stanley for help breaking new ground in green finance. For more than 20 years, Morgan Stanley has worked with Unilever to tap global capital markets and has advised on various mergers and acquisitions. This time, Unilever wanted Morgan Stanley’s expertise at the intersection of finance and sustainability.

Morgan Stanley has long demonstrated leadership in this area. For example, through its Institute for Sustainable Investing, the firm gathers insights from industry experts and develops scalable finance solutions to address global challenges, such as climate change.

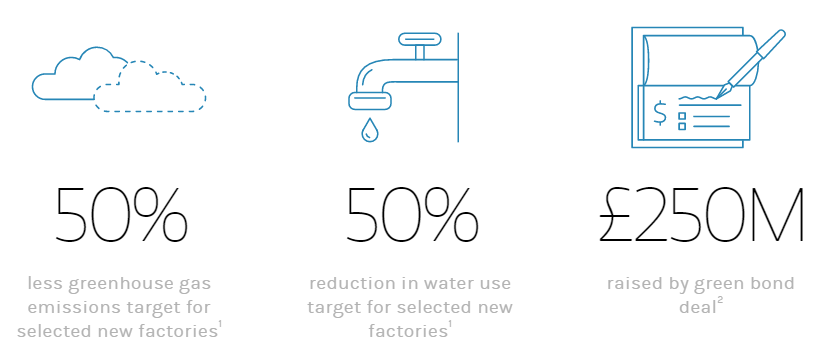

In March 2014, with the help of Morgan Stanley and other financial institutions, Unilever created a £250 million ($415 million)3 green bond, the first sustainability bond ever brought to market by a consumer goods company.2 Proceeds from the offering are tied to environmental activities, such as financing new factories that cut in half greenhouse gas emissions, water use and waste, as well as funding the installation of "lean and green" freezers in Russia, the U.S. and Turkey that use more eco-friendly refrigerants.1

"While delivering 400 brands to two billion people around the world on any given day, Unilever also is expanding the definition of corporate responsibility."

For Unilever, the green bond affirmed its long-standing business practice: Since 2008, Unilever has avoided cumulative costs of more than €400 million (approximately $450 million) by streamlining its manufacturing practices, with energy efficiency playing a big role.4

While delivering 400 brands to two billion people around the world on any given day, Unilever also is expanding the definition of corporate responsibility. With help from Morgan Stanley, the company was able to simultaneously invest in its long-term growth and advance its goals to make sustainable living commonplace. Both Morgan Stanley and Unilever are demonstrating how capital can contribute to ensuring a better future for the planet.

Find a Financial Advisor to discuss your investment goals and strategy.

1 Criteria for project selection, based on Unilever's press release dated March 19, 2014. 2 As per Unilever's press releases dated March 19, 2014, and June 27, 2013. 3 The exchange rate used to calculate "$415 million" was the exchange rate as published by Bloomberg on March 19, 2014, of 1.6644. 4 €400 million in avoided cumulative costs, as described in Unilever's "Sustainable Living Plan, Scaling for Impact, Summary of Progress 2014" dated May 2015. For further details and information about Unilever's green bond issuance, please see Unilever’s press release dated March 19, 2014. © 2015 Morgan Stanley & Co. LLC. Member SIPC. CRC 1313323 10/15

/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/filer/aa/c0/aac0a1f8-1dc3-4af0-b8b7-39ce3310c681/header-image-morgan-stanley-energy-hot-air-balloon.jpg)