SpaceX Wants to Conquer the Internet

But can Starlink overcome the ghosts of satellite constellations past?

/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/filer/c9/fa/c9faaab0-8c5e-486b-ae20-a71e7d448d43/07i_on2020_starlinkdeployment_live.jpg)

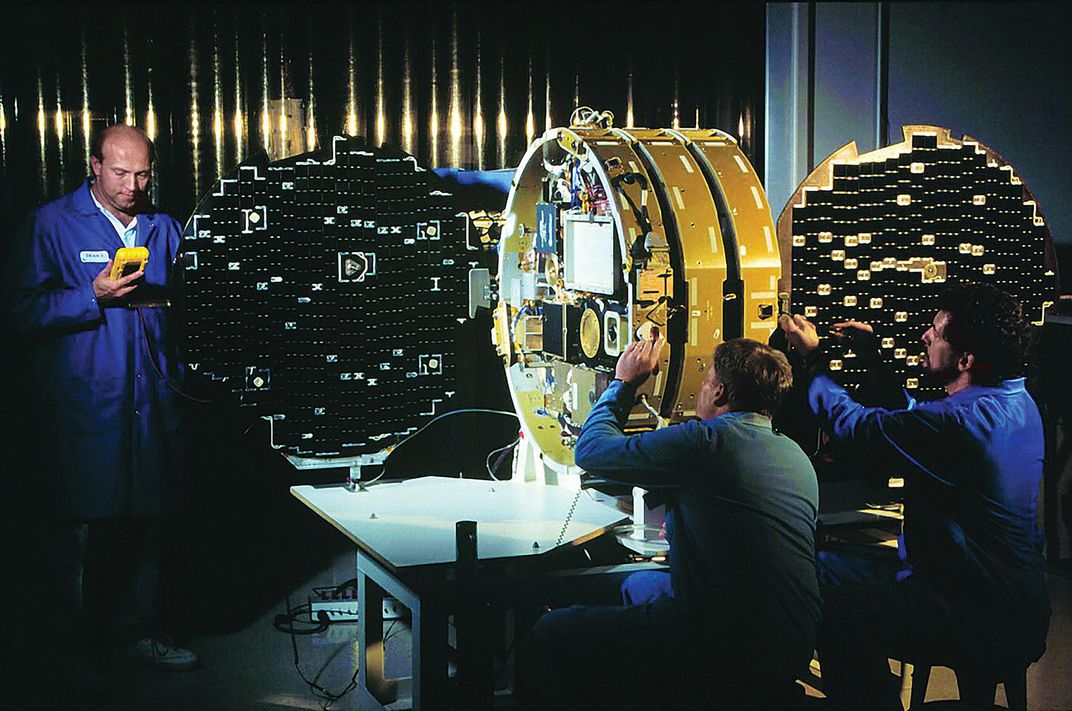

A sunny optimism pervaded the March 9 opening of the Satellite 2020 conference in Washington, D.C., where one of the first sessions was a discussion among operators of large satellite constellations. Panelists included representatives of OneWeb and Elon Musk’s SpaceX, who were competing to gird the globe with satellite Internet connectivity—and grab a share of a broadband market valued at more than $300 billion in 2019. “Very few people are actually happy with their Internet service, especially in the rural areas. A lot of people are unconnected,” said Jonathan Hofeller, SpaceX vice president of Starlink and commercial sales. Starlink is the name SpaceX has given to its planned constellation of more than 12,000 small satellites, aimed at bringing high-speed Internet to those under- and unserved masses. SpaceX has already launched several hundred Starlink satellites, lofting 60 of the flat, stackable, 260-kilogram (573-pound) satellite units at a time—all part of SpaceX’s ambitions to revolutionize life both on the ground and in the heavens. “We’re very public that we want to move on and make life a multi-planetary species,” Hofeller said. “In order to do that, you need a robust space economy.”

For a robust space economy, SpaceX will need a robust Earth economy. As Musk would tell a packed convention hall later that evening, it’s really Starlink he is counting on to send SpaceX to Mars, not his launch business. “The revenue potential of launching rockets, launching satellites, servicing the [International] Space Station—it taps out around $3 billion a year,” Musk said. “Providing broadband is more like an order of magnitude more than that, probably $30 billion a year.” SpaceX has said it plans to begin beta-testing Starlink this year and start commercial service by 2021.

Musk has built a reputation for proving doubters wrong, but using a constellation of smallsats to provide Internet broadband has been tried before. In the 1990s, companies like Teledesic tried to provide Internet by satellite, only to fail spectacularly by the early aughts. Iridium, which today provides voice and data service with a constellation of 66 satellites, was one of the few survivors—and only after a bankruptcy. During the panel discussion, Iridium CEO Matt Desch described his company’s path. “It only took about nine or 10 months from the time of first launch [to when] the bankers were saying, ‘I want my money back,’ ” he said. “It just needed time—like 20 years.”

Starlink competitor OneWeb, meanwhile, would file for bankruptcy just weeks after the March conference ended.

So the big question at Satellite 2020 remains: Can SpaceX succeed where others have failed?

World-Wide Web

Today’s broadband Internet market is much larger than it was when companies first tried to penetrate it with satellite constellations. The hunger for bandwidth seems to know no bounds: Market research firm Grand View Research projects the global market to grow to more than $645 billion by 2027. Even in the United States, there remain pockets of low or no connectivity. The Federal Communications Commission estimates that 19 million Americans (many in the tribal areas and western states) lack access to high-speed Internet. These are the customers SpaceX plans to target. Internationally, there are billions whose lives could be greatly improved by access to the Internet, according to Jim Cashel, the author of The Great Connecting: The Emergence of Global Broadband and How That Changes Everything.

“Even now in 2020, about half the people on the planet have never heard of the Internet,” Cashel says. “It’s three billion people who generally are poor and rural, most in Africa, so they generally don’t have access to information, banking services, government services, health care, education. And with the Internet you can get access to all of those things.” The Internet has been slow to reach those people because it’s expensive to lay fiber optic cables and build cell towers in remote areas, according to Cashel, but Starlink could offer gigabyte service virtually anywhere on the planet from orbit.

“Starlink will serve the hardest-to-serve customers that [telecommunications companies] otherwise have trouble doing with landlines or even with cell radio stations,” Musk said during his conference keynote speech, acknowledging that urban settings will likely remain the province of traditional broadband providers.

The basics of Starlink are not altogether different from existing communications satellite infrastructure, according to Roger Rusch, a satellite industry consultant. Users on the ground will have a terminal to send signals to and receive them from a satellite in orbit. That satellite has another beam that connects with a base station, which is what connects the whole system to the Internet. That much is also true of existing satellite phone and Internet services such as HughesNet and ViaSat.

What’s different about Starlink is that rather than flying giant satellites in geostationary orbit, 22,500 miles up, SpaceX is launching its small satellites into low Earth orbit (LEO) between about 200 and 400 miles in altitude. The idea is to provide satellite Internet connectivity with the low latency of a shorter distance. Although existing connections can lag hundreds of milliseconds, Musk says Starlink will keep latency below 20 milliseconds, “so somebody could play a fast-response video game at a competitive level.”

But there are some trade-offs in choosing LEO over geostationary orbit. LEO satellites are not stationary over the Earth and must move very quickly over its surface to stay in orbit. At such a low altitude, each satellite covers a much smaller patch of ground compared with a geostationary satellite. “Each one of these satellites in LEO can see maybe only two percent of the world,” Rusch says. SpaceX needs an enormous constellation of satellites to ensure users can continuously pick up one satellite, and excellent software and hardware so that user terminals can pick up the next satellite when it comes into range. Maintaining the connection requires a lot of technology to be packed into a user terminal that Musk says will be about the size of a pizza box and work on a plug-and-play basis. “It’s very important that you don’t need a specialist to install,” Musk said during his keynote at the conference. “There’s just two instructions, and they can be done in either order: Point at sky, plug in. And it will work.”

SpaceX has been tight-lipped about exactly how that will work and how much it will cost. (Despite multiple requests, the company declined to answer questions for this story.) And recent history speaks loudly where SpaceX is silent.

Retreat From Low Earth Orbit

“A little bit more than 20 years ago, we had the same level of excitement, followed by disappointment,” says Tim Farrar, a satellite industry consultant who was involved in the industry in the mid-1990s. “There was a lot of excitement around Iridium and GlobalStar and Teledesic,” the latter of which planned to wrap the world in the Internet with a constellation of more than 800 LEO satellites.

Started in 1994 by Craig McCaw, who had made a fortune in the early cellular market, Teledesic initially planned to begin offering Internet service in 2001. Farrar worked on the project as a consultant. “But at the end of the day Craig McCaw looked at what we’d done over the course of about eight years and said, ‘This is what I can build for $10 billion, and this is what the market wants to pay for,’ and concluded there wasn’t an overlap between the two things,” Farrar says. “In that sense, Teledesic was a big success, because they didn’t waste $10 billion finding out it was a bad idea.”

Rusch was also consulting in the 1990s and remembers the enthusiasm for satellite Internet—and notes that the only purveyors still around today are Hughes and what is now ViaSat, both geostationary systems. “The LEO solutions fell by the wayside because they were just outrageously expensive,” he says. “It takes a lot of satellites, it takes a lot of launches. Yes, that stuff is less expensive now than it used to be. It’s probably half the price. But half is not enough.”

And it wasn’t the cost of satellites or rocket launches that turned Teledesic’s math sour. “Actually the vast majority of the cost is in the other parts of the system, the ground segment,” Farrar says. “In other words, all those gateways you need to link back to the satellites around the Earth and particularly the user terminals.”

The Teledesic business plan assumed that user terminals would cost $1,500, Farrar says, and the company expected to sell 10 million of them. The cheapest bid for building the terminals was $4,000 each. “If you work that out, 10 million terminals is going to cost you an extra $25 billion, which far outweighed the $10 billion cost of the system itself,” he says. “That’s what blew up the business plan.”

And then there was the cost of the gateways— larger ground stations spread around the world to keep the satellite network connected to the terrestrial Internet. “Those are very expensive, you’re talking $30 million a pop,” Rusch says, with as many as 50 stations needed for global coverage. “That by itself is going to be a billion and a half more.”

Big capital outlays are not necessarily a problem if you can recoup costs, but Rusch doubts there is anywhere near the amount of money in the satellite broadband market as SpaceX thinks. “The people who need to be served are people who have very limited financial means,” he says.

“What’s left is a fairly narrow slice of the hardest-to-serve customers, plus the core satellite market of ships, planes, and government users who simply can’t use terrestrial infrastructure,” Farrar adds. “That’s not going to produce anything close to the tens of billions of dollars that Musk claims Starlink will generate each year.”

Of course it could work out to everyone’s benefit—with the exception of SpaceX. “We’ve ended up with a lot of the Internet infrastructure funded by the bubble in telecoms in the late ’90s early 2000s, when they built all this fiber that we’re still living off,” Farrar says. “It’s possible there will be some things built now that will be a complete failure economically but will still be useful for people.”

No billions, no funding Mars via Starlink, but perhaps something like Iridium could arise from the ashes to offer a useful service.

Silent Partner?

“Guess how many LEO constellations didn’t go bankrupt? Zero,” said Elon Musk at the Satellite 2020 keynote address. He did not, however, say how much his company planned to charge customers—either for the user terminals or for the service—so that Starlink could avoid that fate. And neither had Hofeller earlier that day, joking at the time that Starlink’s price would be less than whatever OneWeb’s turned out to be. Cashel says that with this lack of detail, it’s impossible to determine whether the company has a viable plan for survival. Analysts are left “trying to read the tea leaves in the different [Federal Communications Commission] statements that SpaceX issues.”

In a May 26 filing with the FCC, for instance, SpaceX simultaneously describes Starlink as complementing rather than competing with terrestrial broadband providers, while more than doubling down on capital investment by requesting approval to operate an additional 30,000 satellites as part of a second-generation constellation. And in mid-July, an apparently leaked Starlink FAQ concerning a test program found its way to Reddit. If the document is legit, SpaceX is looking for beta-testers in the northern United States and Canada, between 44 and 52 degrees latitude. They must have a clear view of the northern sky, a possibly tricky requirement for the satellite broadband-curious in the woodsy Pacific Northwest, but the service will be free, save for a $1 charge to test the billing system.

Beta-testers will get good but intermittent service, according to the document, so it “likely is not suitable for gaming or work purposes.” Instead, testers will answer questions about the service—but only for SpaceX. Testers will have to sign a non-disclosure agreement to participate.

So what does SpaceX know that everyone else can only guess?

“If [Musk] can do the same thing with Starlink,” Rusch says, as he’s done with reusable launch vehicles, “we may be surprised. They may have an incredibly efficient way to manufacture and launch these satellites.”

And it’s possible that SpaceX has a hidden customer strategy as well.

“Honestly, the 800-pound gorilla in the background is the Pentagon,” Cashel says. “Elon Musk has said it’s somewhere between $5 and $10 billion to build out the network; that’s a rounding error for the Pentagon. Already the Pentagon has multi-billion contracts with Iridium, which is for a service that will probably be inferior in terms of capabilities, latency, to Starlink.” And when it comes to providing global broadband access, a report from the World Bank estimates the cost of connecting the unconnected in Africa alone to be a $100 billion endeavor, the sort of investment no one company or even country can handle alone. It is possible that with Starlink, as it did with its early launch business, SpaceX is counting on governments to be its first clients. “Governments can’t live without connectivity in any way, shape, or form, and they only want more and more and more,” Hofeller said during his panel discussion.

The U.S. government could see strategic value in Starlink’s offer of affordable, scalable high-speed Internet access in parts of the globe where Chinese company Huawei is currently the dominant provider through its 4G, and soon to be 5G, cellular networks. Places like Africa, according to Judd Devermont, director of the Africa Program at the Center for Strategic and International Studies. He believes that Starlink, if deployed as advertised in Africa, could be an attractive geopolitical and commercial counterbalance. “I think it’s a great soft power win in terms of Africans being able to look to the U.S. and U.S. companies as the key providers of their Internet access,” Devermont says, and could have a further catalytic effect. “If the continent is able to have reliable, high-speed Internet, think about all the business that can be built on top of that.”

And even if SpaceX isn’t thinking of satellite broadband as a public-private partnership, the market is about to put that strategy to the test. In the wake of its March bankruptcy, what’s left of OneWeb found a new partner: the British government. The U.K. announced in July that it will sink $500 million into Starlink’s rival in return for a reported 20 percent equity share. “With a sovereign global satellite system,” a media release read, OneWeb will “contribute to the government’s plan to join the first rank of space nations, along with our commitment to making the U.K. a world leader in science, research and development.” Another partner in the deal will be the third largest mobile operator in the world, Bharti Global Limited, which will “bring OneWeb a revenue base to contribute towards its future success.” That kind of institutional backstop could prove to be the secret fuel that makes satellite Internet fly.