The ATM is Dead. Long Live the ATM!

Usage is on the decline – so why are banks looking to the machines to save them?

:focal(2928x1619:2929x1620)/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/filer/37/3d/373d2567-9780-4305-9653-41df8272f350/42-59151255.jpg)

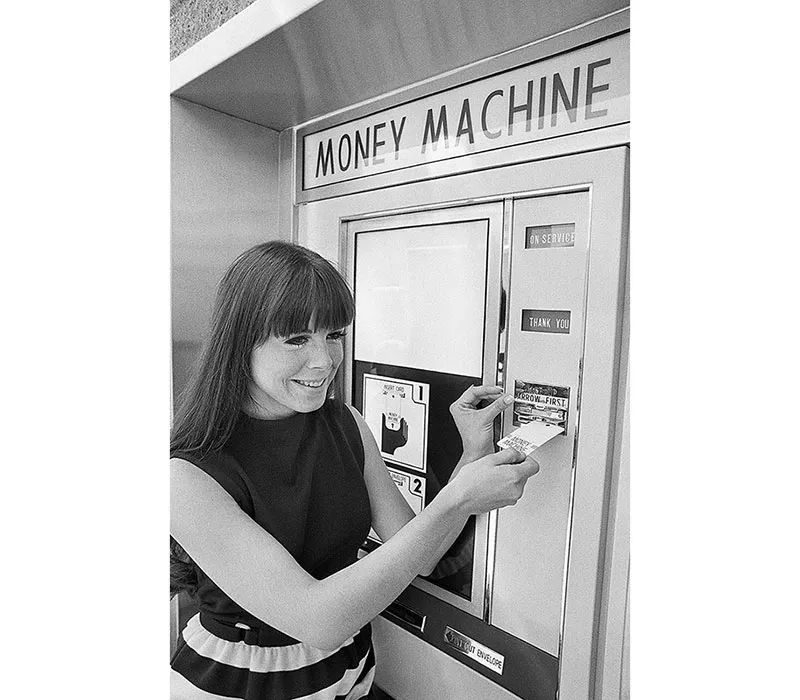

Automated teller machines, better known as ATMs, have been a part of the American landscape since the 1970s—beacons of self-service and convenience, they revolutionized banking in ways we take for granted today. They live to serve; we only really notice them when we can’t seem to locate one.

But in recent years, the ATM no longer does something that no other machine or outlet can do and its days, some say, are numbered. Or is it? Because it looks like at the very moment ATM usage in on the decline, some American banks are doubling-down on their ATM investment.

The “world’s first” ATM landed on a high street in Enfield, a suburb of London, at a branch of Barclays bank; there’s even a blue plaque on the outside of the building, still a Barclays, to memorialize the cash dispenser’s June 27, 1967, debut. The story goes that John Shepherd-Barron, an engineer at printing company De La Rue, came up with what was essentially a cash vending machine one Saturday afternoon after he missed his bank’s open hours. He was, notably, in the bath. Shepherd-Barron he approached Barclays with the idea, a contract was hurriedly drawn up (over a “pink gin”) and soon after, the new cash dispenser – with a £10 maximum withdrawal – sprouted up next to the bank. The machine transformed banking and Shepherd-Barron’s name went down in history: In 2005, he was made an Officer of the Order of the British Empire for his services to banking and the obituaries after his death in 2010 all called him the “inventor of the ATM”.

It’s a good story, although it’s almost certainly not true – “absolutely rubbish,” laughed professor Bernardo Batiz-Lazo, professor of business history and bank management at Bangor University, Wales, and the co-author of a book on the history of the ATM.

Shepherd-Barron was indeed part of the Barclays machine group, though, Batiz-Lazo says, there were several teams working independently to come up with a solution to the same problem: How can you get cash out of your bank after hours without resorting to robbery? It also wasn’t an idea that came from nowhere, eureka moment in the bath aside. Banks had been actively looking for a way to automate the teller process – Batiz-Lazo says that the individual engineers might not have known that anyone else was working on the same ideas, but the banks certainly knew. Moreover, ATM innovation had a number of clear predecessors. Batiz-Lazo pointed to American Luther George Simjian’s invention of the Bankograph in 1960, machine that would allow bank customers to deposit checks and cash into a machine and that spent a short time in the lobby of a New York bank (it didn’t catch on: “The only people using the machines were prostitutes and gamblers who didn’t want to deal with tellers face to face,” Simjian supposedly said). Other progenitors include the application of the magnetic stripe card in things like electronic ticket gates and innovations in self-service gas stations and vending machines.

There were at least two other groups working at the same time as Shepherd-Barron, although there’s some evidence that a cash-dispensing device popped up in Japan briefly even before the Barclays device made its appearance. Just a week after the Barclays cash dispenser was installed, a Swedish cash machine appeared; a month later, Britain’s Westminster Bank rolled out its cash dispenser. Over the next two years, more groups began working on their own machines. 1969 was a big year for ATMs: another British bank, Midland, partnered with tech company Speytech to roll out their machines; Japan’s Omron Tateishi company installed one outside the Sumitomo Bank; and the Chemical Bank in Rockville Centre, New York installed its ATM with the prescient advertising slogan, “On September 2, our banks will open at 9 am and never close again.”

These first devices were not just geographically dispersed, they were technologically all over the place, too. The hurdles in creating an automated cash-dispensing device were pretty substantial, and each machine handled them in different ways. Some machines dispensed cash in plastic cartridges, rather than as individual notes; some had customers use a metal or plastic token that was inserted into the machine and kept, to be mailed back to the customer later; others issued customers stacks of paper, like a check, that were used in the same way.

Omron Tateishi’s machine used a magnetic-stripe card; Barclays machine had customers enter a PIN to identify themselves, and checked that number against what was basically a check inserted into the machine. But security was always an issue – there was no way to really ensure that the user of the token was actually the holder of the account, a fact that proto-hackers in Sweden exploited to great advantage in 1968 when they used a stolen ATM token to withdraw huge amounts of money from different machines. Then there was the fact that ATM electronics were being forced to work in all-weather conditions, resulting in frequent breakdowns. These early ATMs were big, clunky, unreliable, and not incredibly popular.

So why did banks persist in installing them?

The short answer is that despite their limitations, ATMs were at the vanguard of technology and therefore desirable. ATMs emerged in the 1960s and ’70s, out of a brave new world where “self-service” and “automation” were big buzzwords that appealed to a wide swath of people. The longer answer is that each country that worked on developing ATMs had their own reasons and particular social milieu that pushed the dispenser’s innovation. In the U.K., where three of first working ATM prototypes were born, banks were facing unprecedented pressure from banking unions to close on Saturdays. This was around a great period of unionizing in Britain, when workers’ unions had increasing power; at the same time, business leaders were being sold the idea that automation would save labor costs and reduce the influence of the unions. Automating the teller process seemed like a very good idea, one that would satisfy the customers and the banking unions, and even give banks themselves a measure of control.

In the U.S., there was certainly a need for more flexible banking – banks had horrible hours for working people. But at the same time, as much as 30 percent of the American population didn’t bother with banks and why would they? Many American workers received their pay packets at the end of each week in a big wad of cash and after bills were paid, there was either not enough left over to deposit into a bank account or simply no reason to do so. If you were paid in checks, department stores like Sears or J.C. Penney’s would happily cash your check for you – especially if they thought you might spend a bit of it on the way out. However, banks, now increasingly moving into the retail sector, were waking up to the fact that they were losing out on a lot of business. Their interest in rolling out ATMs came from wanting to attract more customers with shiny new gadgetry and then, once they had those customers, up-sell them on things like loans and credit cards. There were also other, bigger reasons banks pushed forward with ATMs, including not having to lengthen banking hours, reducing congestion in bank branches, postponing or even eliminating the need to open new branches while still maintaining a physical presence, and, of course, cutting labor costs. So some banks, like Citibank, pushed ATMs hard.

Ultimately, the ATM was part of a revolution in how banking was seen and saw itself. This shift had to do with what kind of business bankers thought they were in – turns out, it was information processing, not money moving. It also, Batiz-Lazo says, facilitated a shift in the balance of power of banks: People began to identify themselves with the bank’s brand, rather than the individual branch; this was a fundamental change in the role of banks in society. ATMs showed that banking needn’t be tied to a branch or even a human being, prefiguring a world where banking is done 24 hours a day, seven days a week on mobiles and laptops, and definitely not in a branch (more on this later).

In the U.S., customer ATM adoption went slowly: “Money is so primal in our psychology, you can’t make changes to our payments without it causing an immense amount of psychological angst,” says David Stearns, senior lecturer at University of Washington’s Information School on monetary informatics and payment systems. Some banks tried to smooth over that angst by personifying their machines, often in slightly weird ways – a Florida bank introduced its customers to Miss X, the truly creepy clown make-upped “Sleepless Teller”, while First National promoted “Buttons, the Personal Touch Teller”, an anthropomorphized cartoon cash machine. Others, according to a New York Times article from 1977, gave away coupons for ice cream and hamburgers with ATM cards, hired Star Trek actor Leonard Nimoy to lend a space-age cred to the new machines, or gave their employees 25 to 75 cents for each customer they were able to convince to use the machines as an incentive.

It didn’t always work; a flock of articles about the burgeoning bank technology reflects the difficulty banks had in getting customers on board. One Detroit artist told The New York Times in 1977 that she preferred face-to-face banking and that a number of her friends had machines eat their cards: “I’m suspicious,” she said. “At least the girl behind the window doesn’t die in the middle of a transaction.” A dubious banking exec in New York City told the paper that it was great that customer could bank at 3 a.m., but “Where are you going to spend it at 3 a.m.?” (in New York in the 1970s, one suspects lots of places, actually).

But enough people used them that ATMs became more common and their widespread adoption, however frustrated by card-eating and breakdowns, drove innovation. IBM pioneered the online interconnective software that ATMs came to run on, which allowed the terminals to be connected to the banks larger computerized network through dedicated phone lines. Banking de-regulation also pushed ATMs forward, especially after a 1984 US Supreme Court decision ruled that ATMs did not count as branches of banks and therefore were not subject to laws regarding geographic concentration of banks. By the 1980s, ATMs were big business and most banks had adopted them, forcing tech companies to make the devices safer, stronger and capable of doing more; it also forced the machines to standardize, as banking networks became more open. In the 1990s, another ATM market had opened up: Independent automated teller deployers (IADs, to use the lingo) were installing ATMs unaffiliated with specific banks in ever more convenient locations, from corner shops to cruise ships.

Now, ATMs are pretty much everywhere (Wells Fargo Bank even operates two at McMurdo Station in Antarctica). And though they’re capable of doing a lot of useful things such as deposits, payment transfers and balance checking, they’re still basically doing the same thing that they did when they first appeared nearly 50 years ago. Which might be a problem.

There are now more than 420,000 ATMs in America, totaling upwards of 3.2 billion transactions a year, according to the US Government Accountability Office; the vast majority of those transactions, to the tune of nearly 2 billion a year, are cash withdrawals. But if the ATM is primarily a cash-dispensing machine, then its days may be numbered: Cash, if some financial commentators are to be believed, is on its way out.

Basically, people are using cash less and less. Boston-based research firm Aite Group said in 2011 that US use of cash was expected to decline by $200 billion by 2015. The Federal Reserve’s 2013 study of payment methods in America found that on the whole, payments are increasingly card-based, especially debit card. The study also found that the average payment made using a card, whether debit, credit or prepaid, is decreasing, meaning that people are using cards for the kinds of small purchases they once would have used cash to make. MasterCard estimates that 80 percent of consumer spending in the US is cashless, a figure that came in a press release heralding their claim that a number of nations are moving to a cashless society (and should be taken with a grain of salt, given its source).

Then there’s the much-talked-about, almost-cresting mobile payments wave, which allows consumers to use their smartphones to pay for purchases. Venmo, a mobile wallet-cum-social network app that serves up peer-to-peer payments with emoji and millennial élan, is growing dot.com fast: According to Bloomberg Businessweek, it processed $700 million payments in the third quarter of 2014, up $141 million from last year. Apple’s new iPhone 6 comes with Apple Pay, which allows users to use tap existing contactless payment terminals to tap and pay (although, for the moment at least, it seems to be confusing cashiers the world over). The funds come either from the credit card the user’s iTunes account is connected to or another that the user wishes, but, crucially, credit card information is not stored on the phone.

And tech startup Square makes it possible for small merchants to take credits cards using their smartphones without having to pay huge fees to credit card agencies. Places where cash traditionally ruled, for example, the farmers’ market, now take card. Even money exchanges you’d rather not have evidence of can be done electronically – as the big fears around Bitcoin, person-to-person currency that operates without oversight from a central banking authority, have shown.

However, the “cashless society” is an idea that people have been batting around since before the ATM even and, as yet, it hasn’t happened; a number of industry analysts and academics don’t think it will (no matter how much safer it may make America, according to a March 2014 article in The Atlantic correlating decreased cash use with decreased crime). Stearns, who studies the sociological implications of payment in society, noted that cash-based interactions still have power in America, such as dropping a coin in homeless person’s cup, adding your tithe to the collection plate at church, or tipping the valet who parks your car.

Then there’s the fact that people really do still use cash. During the recession, the number of cash transactions actually increased, according to the Federal Reserve – and haven’t yet subsided, even after the recession’s official end. In a report published in April 2014, the Boston, San Francisco and Richmond Federal Reserve Banks found that while the value of cash transactions may be low, at around only $21 on average, the frequency is not – at 40 percent, cash takes the largest single share of financial transaction activity. And that other report claiming that the cash use in the US will decrease by $200 billion by 2015? It also noted that at that rate of decline, roughly 4 percent a year, the use of cash in the US wouldn’t fall below $1 billion before the year 2205. As in about 200 years from now.

But even if America does go cashless at some distant date, that needn’t sound the death knell for ATMs – as long as ATMs provide something we need. And that’s a bit more complicated.

There is significant evidence that ATM usage is on the decline in North America and Europe (not, notably in China, Africa and the Middle East, where ATM usage is exploding – banking research firm RBR’s 2013 report indicates that China alone issued a million new ATM cards every single day). Rabobank, a Dutch multinational banking cooperative which maintains the largest number of ATMs in the Netherlands, is expecting a 30 to 40 percent decrease in the number of ATM interactions – that’s a decline of around 60 million customer visits – by next year. Accordingly, the bank is now taking steps to close a number of their ATMs. Banks in America are also seeing people visiting ATMs less – according to figures from the American Banking Association, only 11 percent of banking customers use ATMs to manage their accounts, down from 17 percent in 2009. Industry experts also note that people are visiting ATMs less than they used to: Where someone may have gone once or twice a week, they now go once every two weeks. Meanwhile, independent ATM operators are reporting a decline in revenue over the last 10 years, although part of that has to do with moribund interchange rates, the fee that financial institutions pay them.

ATMs provide services that are increasingly available from other and often times more convenient sources, from cash back at CVS to depositing checks using your phone’s camera. “For the ATM to survive and be interesting, there would have to be reason for it exist and that would be that it’s got something in its belly that is highly valuable that you want to get closer to consumers… or it’s got some more kind of advanced capability that would cause the banks to more comfortable with you using it in more advanced ways, such as closing an account or opening an account,” saysStearns. Right now, ATMs aren’t entirely succeeding.

“Physical touch with your bank is on the decline across all portals,” says Nancy Bush, banking industry analyst. At the same time, she says, banks are, as always, looking to cut costs while increasing their revenues. The answer, as some banks see it, is to reduce their branch footprint while at the same time equipping their ATMs with more powers – because despite how they’ve stagnated, ATMs actually offer a lot of opportunity.

“We think of it today mainly as a cash dispenser,” says Stearns. “But an ATM is terminal… It’s a device that sits on the edge of the network and becomes the device by which the consumer interacts with the network… That device could be used to do anything on the financial network and it could be used to redeem or purchase any kind of physical objects.” In other words, it could really do just about anything.

Ohio-based Diebold is one of the world’s biggest manufacturers of ATMs, making more than half the ATMs in America, and as such, must be an industry leader in innovation. In 2013, the company unveiled their “millennial” tablet ATM at the Consumer Electronic Show in Las Vegas; the small, snazzy device with touch-screen style interface relies on cloud processing to allow customers to use their smartphones to access their cash at ATMs – no card involved at all. What’s significant about this, says Frank Natoli, Diebold’s chief innovation officer, is that it creates a seamless user experience across all avenues of banking, marrying the mobile to the physical, while being safer and using less energy and space; it also, helpfully, taps into the zeitgeist around mobile payments. And it’s incredibly basic: “We asked ourselves, how can we make this as small as simple and distilled down its essence as possible?” he says. “It’s a tablet and it’s a cash automation device and that’s it.”

If stripped down is one kind of innovation, souped up is another. Natoli said that one South American country – he declined to say which one – Diebold is working with wants to allow customers to use their ATMs to link to other systems outside just the bank, for example, to access their government payment accounts, do peer-to-peer payments, reload prepaid cards, things like that. The idea that the device could provide more than just money services is by no means a new one – in the U.S., ATMs sell stamps, and in the U.K., “cash points” have long been able to top up pre-paid mobile phone minutes – but the expansion into other networks is a significant step.

Those are the kinds of changes being made to the physical device – but Natoli says that the latest big thing in ATM is people: Counter-intuitively, banks are starting to replace the automated “a” in ATM with an actual human. Some Bank of America ATMs, for example, now offer “teller assist”, which connects customers to a real teller sitting in a call centre via a two-way video enabled interface, should they want to (the service, however, operates on limited hours.) Diebold’s biggest competitor, NCR, rolled out 350 of its “interactive teller” machines in 2013.

It’s a version of the “help button”, which would connect a user to a real human, and that Natoli envisions more ATMs coming equipped with in the future: “Consumers, when they know what they’re doing, prefer to serve themselves and do it,” he said. “But when they need help, they want it to be accurate and efficient.”

Another way, however, that ATM innovation is re-introducing humans has less to do with what the ATM can do and more to do with what it frees the human up to do. “If you think about your normal interaction with a teller, most of the interaction is just some pleasantries, but a good percentage of the time, the teller has their head down… the amount of actual eye contact and conversation is low,” Natoli said. The newer wave of ATMs is really about refiguring of the traditional branch, for example, Chase Bank’s Grand Central Station branch which has ATMs on hand to do a wide variety of activities that tellers used to do, such as distribute $1 and $5 bills for exact change withdrawals. In the center of the space is a concierge desk, allowing customers who need more personalized service to get it. “So you start to repurpose what the employees in the branch do, they become aides, advisors, guides,” said Natoli. It goes without saying, too, that freeing tellers from having to do basic transactions also means that they work harder to sell the bank’s other products.

But the biggest question, the question that dogged ATM use from the very beginning, is whether or not customers will use it. “Americans are stubborn, stubbornly resistant to change when it comes to banking and one of the problems right now is that we are still in the middle and sort of tail end of a massive demographic change in this country,” says analyst Bush, noting that comfort and trust are two extremely important factors in money handling. “My mother banks entirely different than I bank, I bank entirely different from the kids of my friends, who never want to go into a bank… The banks have a tough job right now, which is to satisfy a number of constituencies, all of which have varying degrees of technological expertise.”

Customers appear to be approaching the new ATMs with as much gusto and trepidation as they did in 1977, when talking to The New York Times. But ATM makers and banks remain confident, just as they were in the 1970s, that people will come around: “You could say that we’ve experienced the death of the cassette, the death of the CD, but by God, everybody has personal devices to listen to music,” says Natoli. “All we’re going to see is the ATM evolve to serve the customer how they need to be served.”

/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/accounts/headshot/LindaRodriguezMcRobbieLandscape.jpg.jpeg)

/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/accounts/headshot/LindaRodriguezMcRobbieLandscape.jpg.jpeg)