The Restaurant Doodle That Launched a Political Movement

How one economist’s graph on a napkin reshaped the Republican Party and upended tax policy

/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/filer/c2/97/c2976b4f-3b7e-402a-94eb-c1593c9bda76/laffer_napkincr.jpg)

Donald Rumsfeld and Dick Cheney were facing down a tsunami. Working, respectively, as White House chief of staff and assistant, the two men had to figure out how to make newly inaugurated president Gerald Ford a success in the aftermath of the Watergate scandal.

Not only had Ford inherited an economy in tatters when he was sworn in August 9, 1974 (unemployment near 9 percent, no growth in GDP, and inflation near 12 percent), but he’d also just done the equivalent of pulling the pin off a grenade and holding onto it for the explosion: pardoning Richard Nixon. Ford’s approval rating declined precipitously, while the outraged American public began wondering if Ford was in on some kind of deal. Rumsfeld and Cheney needed a plan, and in search of one, they were talking with all the brightest minds in Washington.

So on September 13, 1974, the two White House advisors met economist Arthur Laffer and financial journalist Jude Wanniski at the Two Continents restaurant at the Hotel Washington. They explained Ford’s current plan to pull the economy from the burning wreckage of stagflation: raise taxes 5 percent and earn more government revenue.

“Look, you’re not gonna get 5 percent more revenue with a tax surcharge,” Laffer recalled saying to his companions. “You may get 4 percent more revenue, you might get 3. You might also lose revenue because the tax base will sink.”

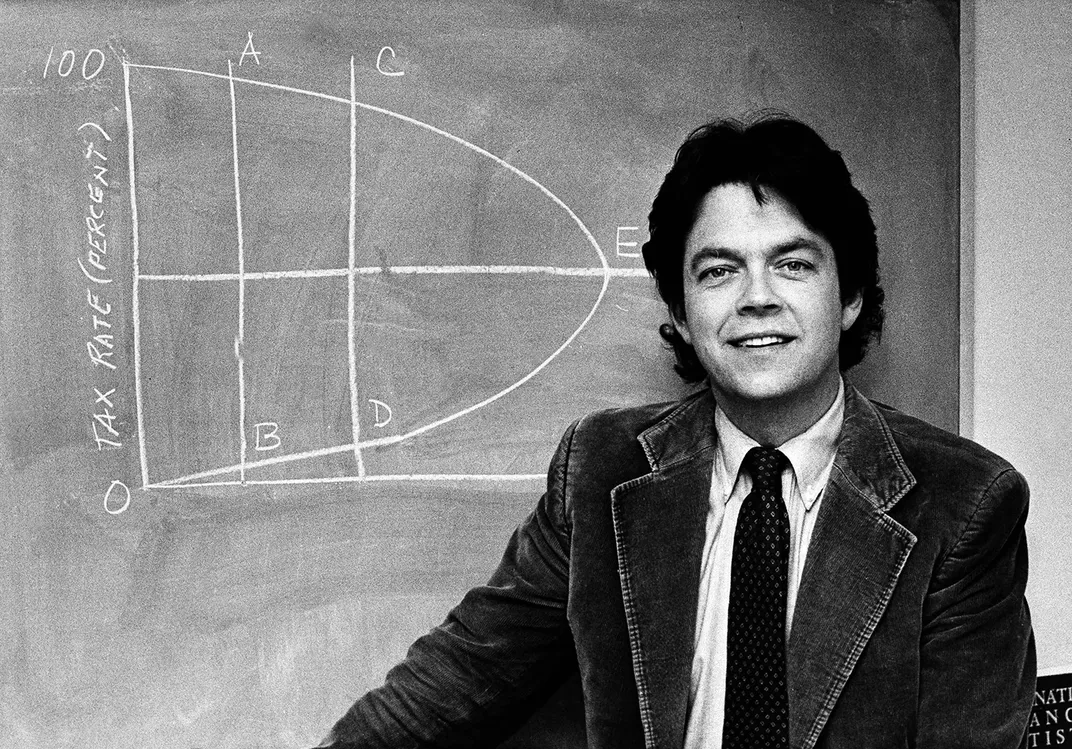

To illustrate his point, Laffer whipped out a marker and began sketching a graph on a white cloth napkin. He drew a curved line that started in the corner, where the x and y-axis meet, ballooned the line out like a bullet emerging from the y-axis, then connected it back to the y-axis at the top of the graph. What his graph showed was tax revenue as a function of tax rates. When taxes (the x-axis) are zero, so is government revenue. When taxes are 100 percent, revenue is zero then as well—no one will buy or sell anything when all of it goes to the government.

Somewhere in the middle is a magic number, the tax rate at which government revenue and economic growth are at a maximum. Go above that point, and revenue will decrease even though taxes are higher, because workers won’t be motivated to work and economic growth will be suppressed. That’s where Laffer thought the American economy already was—in the no-go tax zone.

“We’ve been taxing work, output and income and subsidizing non-work, leisure and unemployment. The consequences are obvious! To Don Rumsfeld,” Laffer wrote around the graph, signing and dating his work as well.

But Rumsfeld didn’t take the napkin, and for a time it fell out of memory. Ford agreed to minimal tax rebates, and by the end of his tenure in 1976, unemployment had dropped to 7.6 percent and inflation to 4.8 percent.

Yet that was hardly the end of the story. Because in 1978, the journalist who’d been seated at that table published a treatise on supply-side economics that used the story of the napkin as a central theory, which its author dubbed “Laffer’s curve.”

Forty years later, Peter Liebhold, a curator at the Smithsonian’s National Museum of American History, was curating artifacts for the 2015 opening of the exhibition “American Enterprise” about the history of entrepreneurship and the growth of commerce dating from the colonial era in the U.S.

Someone suggested he include the napkin. “But there were huge disputes about whether it existed or not,” Liebhold says. “I was of the belief that it didn’t exist.” After all, Laffer himself denied ever having created it. He claimed he had better manners than to think he could ruin a nice napkin with a pen.

As it turned out, the napkin was real—and Jude Wanniski’s widow, Patricia, had it and was willing to donate it to the museum. It was a huge windfall. “Political objects almost never exist. People have meetings, make decisions, but there’s almost never anything to show from that,” Liebhold says. “It turns out that from this particular meeting, something survived.”

On its face, the napkin is just that: a hemmed, white napkin, the kind seen in fancy restaurants of all stripes, only this one has been marked up by a guy who seems to have ignored his mother’s rules on etiquette in order to draw a graph. But the napkin isn’t just a napkin, any more than the graph is just a messy sketch. This is the napkin that launched multiple presidential careers, a curve that made its designer famous, a theory that overturned seven decades of economic policy. And for all its apparent simplicity, the way economists and politicians interpret the curve turns out to be much more complicated than Laffer suggested.

The Great Tax Debate

Arthur Laffer wasn’t the first to propose a tax revenue curve (nor does he take credit for it); philosophers and politicians have been debating how much a government ought to tax its constituents for centuries. Consider Ibn Khaldun, a leading philosopher who is sometimes considered the world’s first sociologist, having created rules for how history and societies should be analyzed. Born in Tunisia in 1332, Khaldun wrote a landmark text on the history of the world and its political dynasties.

In it he quotes another writer to say, “The burden of taxation should be divided according to right and justice and with equity and generality. No exemption is to be given to a nobleman because of his nobility, or to a wealthy man in regard to his wealth.” At the same time, Khaldun recognized that imposing too high of taxes would eventually stop producing more wealth for the state. But what exactly was the rate at which those taxes should be levied?

Early in America’s history, a marginal tax rate was adopted. Income is taxed on a bracket system. This means, hypothetically, that the first $8,000 an individual earns might only be taxed at 5 percent, while everything after that up to $20,000 will be taxed at 10 percent, and then higher and higher.

In the mid-1800s, tax rates were only 2 to 5 percent, and in 1895 the Supreme Court declared income taxes unconstitutional. But in 1913 that decision was overturned with the ratification of the 16th Amendment, and the highest marginal tax rate was placed at 7 percent. It didn’t stay there for long, though, in part due to the two World Wars. By 1917 the top marginal tax rate was 67 percent (on any income over $2 million, adjusted for inflation), and by the time Dwight Eisenhower became president the top marginal rate was 92 percent—though very few people paid that rate. Eventually the top rate settled in around 70 percent, which is where it was when Ford took office.

Two Santas and Voodoo Economics

Which brings us back to the meeting in the Two Continents restaurant, when Wanniski grabbed Laffer’s napkin. After Wanniski published his supply-side economics book in 1978, he went on to briefly work as an economic adviser for Ronald Reagan. Reagan took the idea and ran with it, seeing it as a “Two Santa” gift that would just keep giving.

“The Democratic Party has the Santa Claus of entitlements,” says Liebhold to explain Wanniski's Two Santa Clause Theory. “The public loves entitlements—social security, health insurance, Medicare, Medicaid.” But nobody would ever get elected he says, if they threatened to take away entitlements like social security and Republicans needed a Santa Clause. “The second Santa has to be stronger than the first Santa,” says Liebhold.

And Laffer’s theory gave Reagan that second Santa. If he could cut taxes and preserve entitlements, all without the government budget taking a hit, it would be the perfect package, and it made a perfect campaign platform.

But not every Republican politician was convinced.

“It just isn’t gonna work,” said George H. W. Bush during the 1980 presidential campaign, when he was still running against Reagan. That’s when the infamous term ‘voodoo economics’ was coined, which Bush denied ever saying—until a video proved otherwise.

Despite their disagreement, the men ended up working together, and Reagan made good on his promise to use supply-side economics for the benefit of the people. He signed the 1981 Economic Recovery Tax Act shortly after his election, which included a 25 percent reduction in marginal tax rates and reformed business taxes. The top bracket of the tax rate fell from 70 percent to 30 percent, around which it’s hovered ever since.

So did the tax-slashing work? In Reagan’s first term, unemployment fell from 10.8 percent to 7.3 percent, and the nation’s GDP was 13 percent higher than it had been four years earlier. But so was the federal deficit, which grew to 6 percent of GDP in 1983. Over his two terms, the deficit increased by 142 percent.

The Economics Behind the Politics

What’s the verdict? To start, no one disagrees that a Laffer Curve doesn’t exist: the zero revenue on both ends idea is solid. Where people do find room for disagreement is the idea Reagan proposed, that cutting taxes can increase revenue by spurring business.

“Very few mainstream economists will agree with that statement,” says Mary Eschelbach Hansen, a professor of economics at American University. “The most obvious difficulty to get over [for proponents of supply-side economics] is the Clinton years, when we had increasing taxes and increasing growth. [Today] very few people are experiencing such high marginal tax rates that they actually work less because of it. We could raise another 30 percent more taxes on income tax.”

That estimate comes from the European Central Bank, Hansen says, and it’s echoed by other researchers. “For developed countries, the optimal tax rate is apparently located somewhere between 35 percent and 60 percent. Despite this heterogeneity, one result that emerges from the literature is that taxes in the U.S. are below their optimal level,” write economists at the Center for Research on International Development.

As for the idea that people will stop working when income tax gets too high, that hasn’t been born out in research either. “An extensive literature in labor economics has shown that there is very little impact of changes in tax rates on labor supply for most people,” write economists for the Brookings Institution.

And there are some real dangers to cutting taxes and letting the government deficit balloon, Hansen says. “If people who are paying for government bonds [that fund the deficit] stop feeling those investments are safe and insist upon higher interest rates because they worry the U.S. government has so much debt it won’t be able to meet it—particularly if that happens in an atmosphere where people aren’t keen on higher taxes—it would be bad all around.”

Given all that, why would presidents and politicians continue to build fiscal policy on the mostly-discredited supply-side economics? Because economics is a soft science, Hansen says, and depending on the assumptions you make about human behavior—that people will stop working if their taxes get any higher, that entitlement programs reduce incentive to work—the outcome of your equation will change. Paul Ryan’s tax plan, for example, involves cutting taxes for individuals and businesses along with other changes that he says “offer a better way to dramatic reform—without increasing the deficit. It does so by promoting growth—of American jobs, wages, and ultimately the entire economy.”

“What people believe, evidence aside, is what they believe,” Hansen says of the deep partisan divide on the issue. “It makes sense to want to believe you could get more by paying less. Unfortunately we will get what we pay for.”

/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/accounts/headshot/lorraine.png)

/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/accounts/headshot/lorraine.png)